daa Finance plc Statement

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION DIRECTLY OR INDIRECTLY TO ANY US PERSON (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT (AS DEFINED BELOW)) OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (THE “UNITED STATES”) OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

daa finance plc

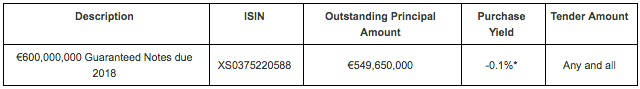

ANNOUNCES TENDER OFFER ON ITS EUR549,650,000 6.5872 PER CENT. NOTES DUE 2018, GUARANTEED BY DAA PLC (ISIN:XS0375220588)

daa finance plc (the Company) announces that it is inviting Qualifying Holders of its €600,000,000 6.5872 per cent. Guaranteed Notes due 2018 guaranteed by daa plc (formerly known as Dublin Airport Authority plc) (the Guarantor) (of which €549,650,000 are currently outstanding) (ISIN: XS0375220588) (the Notes) to submit offers to sell any or all of the Notes held by such Qualifying Holders to the Company for cash (the Tender Offer).

The Tender Offer is made on the terms and subject to the conditions contained in the Tender Offer Memorandum dated 23 May 2016 (the Tender Offer Memorandum) and should be read in conjunction with the Tender Offer Memorandum. Capitalised terms used but not otherwise defined in this announcement shall have the meaning given to them in the Tender Offer Memorandum.

* For information purposes only, the Tender Offer Price of the Notes would be 113.954%, assuming a Settlement Date of 8 June 2016. Should the Settlement Date be postponed, the Tender Offer Price will be recalculated and will be announced at the time of the announcement of the results of the Tender Offer.

Rationale for the Tender Offer

The rationale for the Tender Offer is to optimise the Company’s balance sheet structure. The Company announces today its intention to issue new notes (the New Notes), the proceeds of which will be used to finance this Tender Offer.

Tender Offer

The Company intends to purchase any and all Notes validly Offered for Sale, subject to the right of the Company to accept or reject valid Offers to Sell in its sole and absolute discretion. There is no maximum purchase amount and accepted Offers to Sell will not be subject to pro-ration.

New Financing Condition

Completion of the Tender Offer will be conditional upon the successful completion (in the sole determination of the Company) of the issue of the New Notes (the New Financing Condition), unless the Company (in its sole and absolute discretion) elects to waive the New Financing Condition.

Tender Offer Price and Accrued Interest

The price offered by the Company for the Notes validly submitted for tender and accepted for purchase will be expressed as a percentage of the principal amount rounded to the nearest 0.001 per cent. (with 0.0005 per cent. being rounded upwards). Such price (expressed as a percentage of the principal amount) shall be calculated by reference to a yield of -0.1 per cent. (such yield the Purchase Yield) in accordance with market convention, and is intended to reflect a yield to maturity of the Notes on the Settlement Date of -0.1 per cent.. Specifically, the Tender Offer Price of the Notes will equal (a) the value of all remaining payments of principal and interest on the Notes up to and including the maturity date of such Notes, discounted to the Settlement Date at a discount rate equal to -0.1% per cent., minus (b) the Accrued Interest.

The calculation of the Tender Offer Price and Accrued Interest for the Notes will be made by the Dealer Managers on behalf of the Company, and such calculations will be final and binding on the Noteholders, absent manifest error. The Company will also pay Accrued Interest in respect of Notes accepted for purchase pursuant to the Tender Offer.

Tender Consideration

The Tender Consideration payable on the Settlement Date to a Qualifying Holder whose Notes are validly Offered for Sale and accepted for purchase by the Company pursuant to the Tender Offer will be an amount in euro equal to the sum of: (i) the product of (x) the Tender Offer Price and (y) the principal amount of the relevant Notes; and (ii) the Accrued Interest Amount in respect of such Notes.

Tender Instructions

Any Qualifying Holder who wishes to tender Notes must submit, or arrange for the submission on its behalf of, a valid Electronic Instruction through the Clearing Systems, to be received by the Tender Agent not later than the Expiration Time. Holders are urged to deliver valid Electronic Instructions through the Clearing Systems in accordance with the procedures of, and within the time limit specified by, the Clearing Systems for receipt by the Tender Agent no later than the Expiration Time.

The submission of a valid Electronic Instruction through the Clearing systems will be irrevocable except in the limited circumstances in which the revocation of an Electronic Instruction is specifically permitted in accordance with the terms of the Tender Offer.

Notes may only be Offered for Sale in the denomination of €50,000 or an integral multiple of €1,000 in excess of such amount.

Indicative Timetable for the Tender Offer

THE TENDER OFFER WILL COMMENCE ON 23 MAY 2016 AND WILL EXPIRE AT 16.00 (LONDON TIME) ON 31 MAY 2016 UNLESS EXTENDED, WITHDRAWN, AMENDED OR TERMINATED AT THE SOLE DISCRETION OF THE COMPANY.

Qualifying Holders are invited to Offer to Sell their Notes during the Tender Offer Period.

Events Times and Dates

Commencement of the Tender Offer 23 May 2016

Expiration Time 16.00 (London time) on 31 May 2016

1 June 2016

Announcement of whether the Company will accept, subject to the New Financing Condition being waived by the Company in its sole and absolute discretion or satisfied, any Notes pursuant to the Tender Offer, and, if so accepted, of (i) the Tender Offer Price and the Accrued Interest for the Notes accepted for purchase and (ii) the aggregate principal amount of Notes so tendered and accepted for purchase.

08 June 2016

Expected Settlement Date for the Tender Offer.

This is an indicative timetable and is subject to the right of the Company to extend, re-open, amend and/or terminate the Tender Offer (subject to applicable law and as provided in the Tender Offer Memorandum).

Qualifying Holders are advised to check with any bank, securities broker or other intermediary through which they hold Notes whether such intermediary needs to receive instructions from a Qualifying Holder before the deadlines set out above in order for that Qualifying Holder to be able to participate in, or (in the limited circumstances in which revocation is permitted) revoke their instruction to participate in, the Tender Offer. The deadlines set by such intermediary and each Clearing System for the submission of Tender Instructions will also be earlier than the relevant deadlines above.

Qualifying Holders are advised to read carefully the Tender Offer Memorandum for full details of, and information on the procedures for participating in, the Tender Offer.

Barclays Bank PLC and BNP Paribas are acting as Dealer Managers for the Tender Offer and Lucid Issuer Services Limited is acting as Tender Agent. For detailed terms of the Tender Offer please refer to the Tender Offer Memorandum which (subject to distribution restrictions) can be obtained from the Dealer Managers and the Tender Agent referred to below:

DEALER MANAGERS

Barclays Bank PLC

5 The North Colonnade

Canary Wharf

London E14 4BB

United Kingdom

Tel: +44 20 3134 8515

Attention: Liability Management Group

Email: eu.lm@barclays.com

BNP Paribas

10 Harewood Avenue

London NW1 6AA

United Kingdom

Telephone: +44 20 7595 8668

Attention: Liability Management Group

Email: liability.management@bnpparibas.com

THE TENDER AGENT

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom

Tel: 44 20 7704 0880

Attention: Yves Théis

Email: daa@lucid-is.com

DISCLAIMER

This announcement must be read in conjunction with the Tender Offer Memorandum. This announcement and the Tender Offer Memorandum contain important information which should be read carefully before any decision is made with respect to the Tender Offer. If any Qualifying Holder is in any doubt as to the action it should take, it is recommended to seek its own financial advice, including as to any tax consequences, from its stockbroker, bank manager, solicitor, accountant or other independent financial adviser. Any individual or company whose Notes are held on its behalf by a broker, dealer, bank, custodian, trust company or other nominee must contact such entity if it wishes to offer Notes in the Tender Offer. None of the Company, the Guarantor, the Dealer Managers or the Tender Agent nor any of their respective directors, employees or affiliates makes any recommendation whether Qualifying Holders should offer Notes in the Tender Offer.

OFFER RESTRICTIONS

Neither this announcement nor the Tender Offer Memorandum constitutes an invitation to participate in the Tender Offer in or from any jurisdiction in or from which, or to or from any person to or from whom, it is unlawful to make such invitation under applicable securities laws. The distribution of this announcement and the Tender Offer Memorandum in certain jurisdictions may be restricted by law. Persons into whose possession this announcement and/or the Tender Offer Memorandum comes are required by each of the Company, the Dealer Managers and the Tender Agent to inform themselves about and to observe, any such restrictions. Nothing in this announcement or in the Tender Offer Memorandum constitutes an offer to sell or the solicitation of an offer to buy the New Notes in the United States or any other jurisdiction.

United States. The Tender Offer is not being made and will not be made directly or indirectly in or into, or by use of the mails of, or by any means or instrumentality (including, without limitation, facsimile transmission, telex, telephone, email and other forms of electronic transmission) of interstate or foreign commerce of, or of any facilities of a national securities exchange in the United States or to U.S. persons as defined in Regulation S of the U.S. Securities Act of 1933, as amended (the Securities Act) (each a U.S. person) and the Notes may not be tendered in the Tender Offer by any such use, means, instrumentality or facility from or within the United States, by persons located or resident in the United States or by U.S. persons.

Accordingly, copies of this announcement, the Tender Offer Memorandum and any documents or materials related to this Tender Offer are not being, and must not be, directly or indirectly, mailed or otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees, trustees) in or into the United States or to any persons located or resident in the United States. Any purported offer to sell in response to this Tender Offer resulting directly or indirectly from a violation of these restrictions will be invalid, and offers to sell made by a person located or resident in the United States or any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving instructions from within the United States or any U.S. person will not be accepted.

Each Holder of Notes participating in the Tender Offer will represent that it is not a U.S. person, it is not located in the United States and it is not participating in the Tender Offer from the United States or it is acting on a non-discretionary basis for a principal that is not a U.S. person, that is located outside the United States and that is not giving an order to participate in the Tender Offer from the United States.

For the purposes of the above paragraph, United States means the United States of America, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, Wake Island and the Northern Mariana Islands), any state of the United States of America and the District of Columbia.

United Kingdom. The communication of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Tender Offer is not being made and such documents and/or materials have not been approved by an authorised person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Financial Promotion Order)) or persons who are within Article 43 of the Financial Promotion Order or any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order.

Ireland. The Tender Offer is not being made, directly or indirectly, to the public in Ireland and no offers or sales of any notes or securities under or in connection with such Tender Offer may be effected to persons in Ireland except in conformity with the provisions of Irish laws and regulations (the “Applicable Irish Laws”) including (i) the Companies Act 2014 (ii) the Prospectus (Directive 2003/71/EC) Regulations 2005 (as amended) and any rules issued under Section 1363 of the Companies Act by the Central Bank of Ireland (the “Central Bank”), (iii) the European Communities (Markets in Financial Instruments) Regulations 2007 (Nos 1 to 3) (as amended) including, without limitation, Regulations 7 and 152 thereof or any codes of conduct issued in connection therewith, and the provisions of the Investor Compensation Act 1998, (iv) the Market Abuse (Directive 2003/6/EC) Regulations 2005 (as amended) and any rules issued under Section 1370 of the Companies Act, and (v) the Central Bank Acts 1942 to 2015 (as amended) and any codes of conduct rules made under Section 117(1) of the Central Bank Act 1989.

This announcement, the Tender Offer Memorandum and any other documents or materials relating to the Tender Offer must not be distributed to persons in Ireland otherwise than in conformity with the provisions of the Applicable Irish Laws.

France. The Tender Offer is not being made, directly or indirectly, to the public in the Republic of France. This announcement, the Tender Offer Memorandum and any other offering material relating to the Tender Offer may not be distributed to the public in the Republic of France and only (i) providers of investment services relating to portfolio management for the account of third parties (personne fournissant le service d’investissement de gestion de portefeuille pour compte de tiers) and/ or (ii) qualified investors (investisseurs qualifiés), other than individuals, acting for their own account, as defined in and in accordance with Articles L.411-1, L.411-2 and D.411-1 of the French Code monétaire et financier are eligible to participate in the Tender Offer. Neither this announcement, the Tender Offer Memorandum, nor any other such offering material has been submitted for clearance to the Autorité des marchés financiers.

Italy. The Tender Offer has not been notified to CONSOB (Commissione Nazionale per le Societí e la Borsa) and neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Tender Offer and/or to the Notes have been or will be submitted to the clearance procedure of CONSOB, pursuant to applicable Italian laws and regulations.

The Tender Offer is being carried out in Italy as an exempted offer pursuant to article 101-bis, paragraph 3-bis, of the Legislative Decree No. 58 of 24 February 1998, as amended (the Financial Services Act) and article 35-bis, paragraph 4, of the CONSOB Regulation No. 11971 of 14 May 1999, as amended.

Investors located in Italy can tender Notes through authorised entities (such as investment firms, banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial Services Act, CONSOB Regulation No. 16190 of 29 October 2007, as amended from time to time, and Legislative Decree No. 385 of 1 September 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB, the Bank of Italy or any other Italian authority.

Belgium. Neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Tender Offer have been submitted to or will be submitted for approval or recognition to the Belgian Financial Services and Markets Authority (“Autorité des services et marchés financiers / Autoriteit voor financií«le diensten en markten”) and, accordingly, the Tender Offer may not be made in Belgium by way of a public offering, as defined in Articles 3 and 6 of the Belgian Law of 1 April 2007 on public takeover bids (as amended). Accordingly, the Tender Offer may not be advertised and the Tender Offer will not be extended, and neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Tender Offer (including any memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or indirectly, to any person in Belgium other than “qualified investors” within the meaning of Article 10 of the Belgian Law of 16 June 2006 on the public offer of placement instruments and the admission to trading of placement instruments on regulated markets (as amended), acting on their own account. Insofar as Belgium is concerned, this announcement and the Tender Offer Memorandum have been issued only for the personal use of the above qualified investors and exclusively for the purpose of the Tender Offer. Accordingly, the information contained in this announcement and/or the Tender Offer Memorandum may not be used for any other purpose or disclosed to any other person in Belgium.

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-í -vis clients in connection with the Notes or the Tender Offer.