Annual Reports

daa’s principal activities include the operation and management of Dublin and Cork airports, global airport retailing through our subsidiary ARI, and international aviation consultancy with daa International. The company is State-owned and headquartered at Dublin Airport.

Debt

daa Debt Information

As at 31 December 2024

| Instrument | Maturity | Current Outstanding |

|---|---|---|

| Eurobond | June 2028 | €550m |

| Eurobond | November 2032 | €500m |

| Various EIB Facilities | Amortising to 2040 | €525m |

| Revolving Credit Facility (RCF) (€450m) | March 2027 | €NIL (Undrawn) |

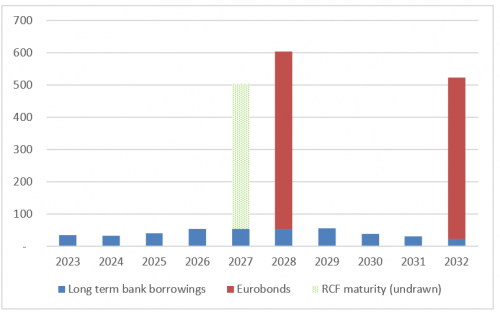

daa Debt Maturity

As at 31 December 2024

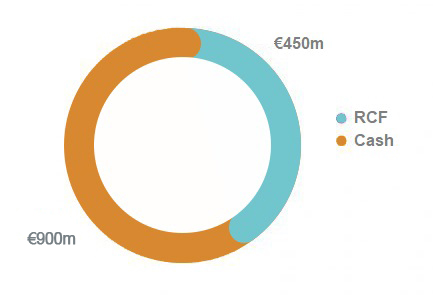

daa Debt Liquidity

As at 31 December 2024

Bond Documentation

| Bond 2028 | Tap 2028 | Bond 2032 | |

|---|---|---|---|

| Trust Deed | Click Here | Click Here | Click Here |

| Prospectus | Click Here | Click Here | Click Here |

| Paying Agency Agreement | Click Here | Click Here | Click Here |

| daa plc (Guarantor) | daa finance plc (Issuer) | |

|---|---|---|

| Constitution | Click Here | Click Here |

Debt Investor Presentations

| Month | Presentation |

|---|---|

| May 2025 | Open Presentation |

| June 2024 | Open Presentation |

| May 2023 | Open Presentation |

| July 2022 | Open Presentation |

| September 2021 | Open Presentation |

| May 2021 | Open Presentation |

| October 2020 | Open Presentation |

Credit Rating

| Long-term Rating | Short-term Rating | Outlook | |

|---|---|---|---|

| S&P Global Ratings | A | A-1 | Stable |

Passenger Statistics

Regulation

The Irish Aviation Authority (IAA) is responsible for the regulation of airport charges at Irish airports. Dublin Airport is the only airport currently subject to economic regulation by the IAA. Determining airport charges on the basis of independent, objective and transparent criteria, as well as sound economic principles is an important principle. The IAA sets charges at Dublin Airport following submissions from daa, airlines and other interested parties. The legislation also provides that the IAA assumes responsibility for the regulation of charges for terminal services and for a number of other aviation functions that were previously the responsibility of the Minister for Public Enterprise. Details of the IAA’s decisions in relation to airport charges at Dublin Airport can be found on the IAA website.